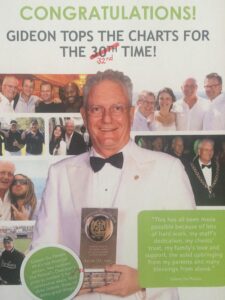

Gideon du Plessis is Highest Earning Insurance Agent in the World

Gideon du Plessis is Highest Earning Insurance Agent in the World

Gideon du Plessis failed in the 10th standard and never went to college. He is today the highest earning insurance agent in the world, with annual commissions amounting to Rs 7 crore (Rs 70 million).

A record he has maintained over the last 12-14 years, selling 700 policies yearly. Labeled by the Million Dollar Round Table — an international association of leading life insurance and financial services professionals — as “the most productive agent in the world”, Plessis’ efforts mean an average daily accretion of two risk covers for his insurance company Old Mutual Plc.

What is Plessis’ secret of success? He lives by 12 mantras that have taken him so far since he got into the insurance selling profession 23 years back.

Based in Cape Town (South Africa), Plessis starts his week on Monday morning at 5:30. He flies 2,000 km to meet his clients in various parts of South Africa, works 17 hours at a stretch — doing business across office desks and/or over a cup of tea in the comfort of clients’ homes, encounters at least six to eight persons daily, and then relaxes over the weekends playing golf.

But ask Plessis as to how he sells insurance. And he’ll tell you he does not. “People buy people, not policies,” he told Business Standard in an exclusive interview.

Insurance continues to be sold and not bought. So the idea is to ask questions and more questions, collect all the information about the client, and then go back to him/her with a solution. You are not selling anything to anybody ever, but rather providing a solution to meet his/her needs, said Plessis.

Plessis was on a tour of India last week, educating the agency force of OM Kotak Mahindra Life, Old Mutual’s joint venture in the country, on succeeding in the insurance business.

“It is important to pay attention to detail. Flowers on your client’s birthday, condolences when the secretary’s distant relative passes away. The personal touch matters and goes a long way,” he advised local agents, who were more keen to learn if he sat on the chair or the sofa when doing business.

Since the age of 10, Plessis wanted to earn money with his mouth. Aiming to be a teacher, but having failed in English, Plessis decided that salesmanship was where his talent lies. Plessis started as a postman, then became a bank clerk visiting farms to sell products, before he was picked up by Old Mutual to sell insurance policies. Since then, Plessis has never looked back.

Plessis does not only target the high-networth individual. Rather, 60 percent of his clients are from the middle class.

Plessis does not only target the high-networth individual. Rather, 60 percent of his clients are from the middle class.

Plessis’ lives by 12 mantras that have taken him so far since he got into the insurance selling profession 23 years back.

Plessis’ daily mantras are;

- See at least six to eight people daily

- Selling is not telling: ask a lot of questions go back with a solution.

- Attend to details

- Go soft in life

- Delegate staff

- People buy people, not policies

- Educate yourself properly

- Time management

- Wake up to achieve what you want

- Elephants don’t bite, mosquitoes do

- Desire

- Enthusiasm