Why New York Workers’ Compensation Penalties for your Business Matter? Workers’ compensation in New York is a no‑fault system that provides medical care and wage replacement to employees injured on the job. Most employers with one or more employees must carry this coverage. If you fall out of compliance, significant penalties may follow as enforced by the NY Workers’ Compensation Board (WCB), under the authority of the New York Department of Labor.

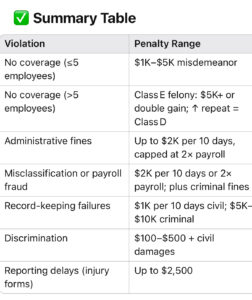

⛔ Failing to Secure Workers’ Compensation

- For up to five employees within 12 months:

A misdemeanor with fines between $1,000–$5,000. Reasonable efforts to secure coverage may be considered a valid defense. - For more than five employees:

A Class E felony punishable by imprisonment of up to four years, or a fine of at least $5,000, or twice any financial gain from the violation, or both. Repeat violations within five years escalate to a Class D felony, with penalties ranging from $10,000–$50,000 plus any additional statutory penalties. - Administrative fines: The WCB may impose up to $2,000 for each 10-day lapse in coverage—capped at twice the worker compensation cost for the affected period.

🚫 Discriminating Against Workers’ Compensation Claimants

- Employers cannot ask about or act against applicants or employees based on prior or pending workers’ compensation claims.

- Violations may lead to misdemeanor charges, penalties up to $1,000, and civil liability, including wages, damages, and legal fees.

- The WCB may order reinstatement, lost wage reimbursement, and a fine of $100–$500, separately imposed on the employer (not covered by insurance).

📌 Notice Posting Requirements

Workers’ compensation policy notices must be prominently displayed in the workplace in both English and Spanish (required since January 1, 2020). Failure to post the notice can result in fines up to $500 per violation, and may be used as evidence of non-compliance.

📄 Reporting and Filing Failures

Refusing or neglecting to submit required injury reports can result in:

- A misdemeanor charge with fines up to $1,000,

- Additional WCB fines up to $2,500.

🕵️ Fraudulent Activity

- Making knowingly false statements or misrepresentations in claims or investigations may trigger charges of Class E felony, or Class D felony for repeated offenses within 10 years.

- Penalties include imprisonment, fines of at least $5,000 (or double the fraud gain, ranging up to $10,000 for corporations), or both.

📋 Additional Violations Under WCL

Workers’ Compensation Law (§52, §131) also covers:

- Misrepresentation or payroll fraud: Intentional misclassification, underreporting wages, or hiding employees can result in civil penalties up to $2,000 per 10-day lapse or twice the compensation cost, plus criminal penalties ranging from $1,000 up to $50,000, depending on severity and recurrence.

- Failure to maintain accurate records: Employers are obligated to preserve employee counts, classifications, wages, and accident records for four years. Fines can run from $5,000–$10,000 for first offenses, or higher for felony-level repeat violations. Civil penalties may also reach $1,000 per 10-day period, or double the compensation cost for the period.

- Stop-work orders: The WCB can issue these to halt operations if coverage is lacking or penalties are unpaid.

- Debarment from public contracts: Employers convicted of WCL infractions may face debarment—one year for misdemeanors or civil fines, up to five years for felony convictions or discrimination violations.

- Failure to file injury reports: Penalties of up to $2,500 may apply for missing or late First Report of Injury filings.

New York Workers’ Compensation Penalties for Employers

- Civil Penalty: The Board can assess a penalty of up to $2,000 for every 10 days without coverage. The actual rate often scales based on the number of employees:

- 5 or fewer employees: $500 per 10-day period.

- 6–10 employees: $750 per 10-day period.

- 11–24 employees: $1,000 per 10-day period.

- 25 or more employees: $2,000 per 10-day period.

🛠 Resolving New York Workers’ Compensation Penalties and Compliance Issues

- Employers have 30 days after receiving a penalty notice to request a review. You can explain the lapse, support mitigation, and potentially get reductions or dismissals of penalties.

- If you believe coverage was not required or existed, you may submit documentation (e.g., tax returns, exemption proofs) or have your insurance carrier file a corrected coverage record using your FEIN.

- Offers of settlement may be considered based on your premium level. Payment plans (often interest-free for up to 12 months) may be available—though resolving the debt doesn’t automatically restore eligibility for public contracts if debarment remains.