What is the Experience Modification Factor?

A workers comp modification factor, or experience modification factor, is a number that modifies a business’s workers’ compensation insurance premium, comparing its safety record and past claim costs to those of similar businesses in the same industry. A factor of 1.00 means the business has an average safety record, while a factor below 1.00 indicates better-than-average claims and results in a premium credit, and a factor above 1.00 means worse-than-average claims and leads to a premium debit.

In doing so, you could be held liable for hospital bills and salary compensation for their missed time. Nobody wants to have to pay those expenses out of pocket, so workers compensation insurance becomes even more crucial.

If you are worried about paying high premiums on your workers comp policies, consider taking a look at your internal safety measures. Do you have proper warning signs in place around machinery and equipment that could be hazardous? Are employees required to take regular breaks so that they are not working while fatigued?

If your New York workers’ comp insurance premiums are very high, there are several strategies you can consider to reduce costs while staying compliant:

1. Audit Your Current Policy

- Check your payroll classifications: Many businesses overpay because workers are placed in the wrong classification code. For example, office staff should not be classified under high-risk construction codes.

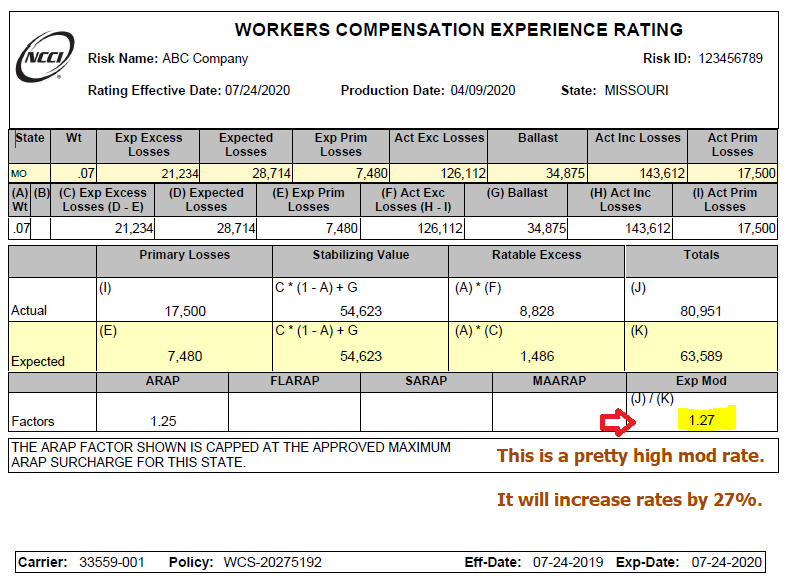

- Review experience modification factor (MOD): Your premium is adjusted by your claims history. Errors in reporting can increase your costs. Request an audit.

- Verify payroll estimates: Workers’ comp premiums are based on projected payroll—if you’ve overestimated, you may be overpaying.

2. Improve Workplace Safety

- Fewer claims = lower experience MOD factor = lower premiums.

- Invest in safety training, equipment, and OSHA compliance.

- Develop a return-to-work program to reduce claim severity.

3. Shop Around

- Different carriers in New York may rate your risk differently.

- Use an independent insurance broker who specializes in workers’ comp to compare carriers.

4. Consider Group Programs

- Some trade associations and professional groups in New York offer safety group programs that pool employers together to get discounted rates.

5. Manage Claims Proactively

- Investigate claims quickly and work closely with your carrier.

- Contest fraudulent or exaggerated claims.

- Encourage employees to report injuries early.

6. Explore Premium Payment Options

- Some insurers allow pay-as-you-go workers’ comp, where premiums are based on actual payroll each pay period instead of an annual estimate. This avoids large upfront costs and overpayments.

🔹 What is the modification Factor?

- Every employer in NY with a premium above a certain threshold (usually ~$5,000–$10,000 annually) receives an experience modification rating.

- It’s a number, usually between 0.50 and 2.00, applied to your base premium.

- MOD = 1.00 → average risk for your industry.

- MOD < 1.00 → fewer/milder claims than average → you get a credit (discount).

- MOD > 1.00 → more/frequent claims than average → you pay a surcharge.

So, if your base premium is $100,000:

- MOD 0.80 → $80,000 premium

- MOD 1.25 → $125,000 premium

🔹 How modification factor is Calculated

- Payroll data (per classification code).

- Expected losses for your type of business (based on industry averages).

- Actual losses (claims you had, weighted heavily toward frequency, not just severity).

- One $100,000 claim hurts you less than ten $10,000 claims — because multiple small claims suggest a systemic safety issue.

🔹 How to Lower Your MOD (and premiums)

- Improve Safety Culture

- Frequent small claims are the fastest way to raise MOD.

- Regular training, safety incentives, and audits reduce injuries.

- Create a Return-to-Work Program

- Getting injured employees back in a light-duty or transitional role reduces the cost of claims.

- The shorter the time off work, the lower the claim cost → lowers your MOD.

- Report & Manage Claims Quickly

- Report injuries right away.

- Stay in touch with the injured worker and their doctor.

- Push for resolution before claims escalate.

- Audit Claim Reserves

- Insurers set aside money (reserves) for expected future payouts. Sometimes these are set too high.

- Work with your broker to review open claims and ask for reserve reductions if appropriate.

- Separate High-Risk & Low-Risk Payroll

- Make sure clerical staff, salespeople, or remote workers aren’t grouped with field/operational workers.

- This reduces your base premium and prevents MOD inflation.

- Safety Groups in NY

- Joining a state-approved Safety Group Program can reduce your MOD or offset it with group dividends.

⚖️ Bottom Line:

Your modification factor is essentially your company’s “credit score” for workers’ comp.

- Keep claims low (especially small ones).

- Review claims and payroll classifications annually.

- Use proactive safety + return-to-work strategies.

Simple, realistic (but simplified) MOD example

Assumptions (illustrative):

- “Split point” (primary loss cap per claim): $17,500

- Weight on losses above the split point: 20%

- Your expected losses (from payroll/class):

- Expected primary = $25,000

- Expected excess = $25,000

- Expected (weighted) losses = $25,000 + 20% × $25,000 = $30,000

Scenario A — One big claim ($100,000)

- Primary portion: min($100,000, $17,500) = $17,500

- Excess portion: $100,000 − $17,500 = $82,500

- Weighted actual losses: $17,500 + 20% × $82,500 = $34,000

- MOD = $34,000 / $30,000 = 1.13

Premium impact (base premium = $100,000):

Final premium ≈ $113,333

Scenario B — Five small claims ($10,000 each; total $50,000)

- Each claim is fully “primary” (all below $17,500)

- Primary total = 5 × $10,000 = $50,000

- Excess = $0

- Weighted actual losses = $50,000

- MOD = $50,000 / $30,000 = 1.67

Premium impact (base premium = $100,000):

Final premium ≈ $166,667

👉 Takeaway: Many small claims can hurt your MOD far more than one large claim, because primary losses (frequency) are weighted most heavily.

How to push your modification factor down (practical moves)

- Attack frequency first

- Safety coaching, near-miss reporting, PPE discipline, stretch/warm-up routines.

- Track and fix the few tasks that generate most minor injuries.

- Return-to-Work (light duty)

- Keeps claims from turning into costly indemnity time-loss claims.

- Reserve reviews (timing matters!)

- Ask your broker for your MOD valuation date (the day losses “lock in” for the next MOD).

- Push to close claims or reduce reserves before that date.

- Tight classifications & payroll segregation

- Make sure clerical/sales/remote payroll isn’t lumped with field ops.

- Verify all subcontractor certificates of insurance (to avoid unexpected payroll pick-ups).

- Medical provider panel & triage

- Steer injuries to occupational clinics familiar with return-to-work.

- Use nurse triage to resolve first-aid–level incidents without unnecessary claims.

If you want, share a quick snapshot of: (a) your top class codes and payroll, (b) open claims with reserves, and (c) your last MOD worksheet numbers. I can map out where the leverage is and estimate how much each fix could move your next MOD.