What Is a Certificate of Liability Insurance?

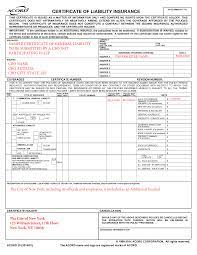

Certificate of Liability Insurance (also called COIs or Certificates of Insurance) summarize the important details of your insurance, listing your policy number, limits, and other information.

Certificate of Liability Insurance serve vital business functions, as they are frequently required to close deals and make insurance claims.

What Information Is on a Certificate of Liability Insurance?

Your COI puts much of your important insurance information in one place. Insurance Certificates list:

- The insured parties (the persons or entities insured by the insurance company)

- Insurance provider

- Policy number

- Coverage amounts / limits

- Effective date

- Expiration date

- Type of insurance

By putting all this information together, Certificate of Liability Insurance make it easy for your business to get the details of an insurance policy.

Use Certificate of Liability Insurance When Signing Contracts

When you sign a contract, your potential business partners often require you to show them your business’s Certificate of Liability Insurance. This is a fairly standard practice. You’ll probably want to see your business partners and contractors’ insurance certificates as well.

Let’s say you’re in talks with a prospective client. They want your business to provide a service for them for the next 12 months. When these talks reach the critical point, you’ll need to demonstrate that your business has adequate General Liability, Errors and Omissions Insurance, and other business liability insurance. Before you can sign on the dotted line, you’ll have to show them your Certificate of Liability Insurance.

Request Insurance Certificates when Hiring Temporary Workers or Contractors

If you are hiring a temporary employee from an agency, consider asking for the agency’s COI. If the temp is going to be doing any work with a lot of liability exposure, (like working with sensitive data) you’ll want to know that the temp agency’s liability insurance will cover incidents and accidents.

Similarly, you should ask to see Certificate of Liability Insurance for any contractors or subcontractors that you hire. Contractors and other professionals work on your property and put your property and employees at risk. Requesting their certificate will show you that if they damage your property, their insurance could cover the cost.

If you hire a subcontractors, they’ll be working alongside you and directly affect the finished product you deliver to your customers. Poor work or mistakes by a contractor could lead to a lawsuit against you. Certificates of Liability Insurance show you that your subcontractors are insured.

Use Certificate of Liability Insurance With Insurance Claims

When someone sues your business, they’ll probably ask to see your insurance certificate again. Many insurance companies will ask you to keep a file of all the relevant insurance certificates of businesses that you have signed contracts with.

If you need to file a claim that involves a subcontractor, you may need to get their insurance certificate. If your insurance agency audits your business as part of its due diligence, you need to track down the relevant COIs.

What Is the Difference between your Policy and your Certificate of Insurance?

Your certificate is one sheet of paper and your policy is many, many sheets of paper. Your policy is the long contract that specifies what is and is not covered in your insurance. It’s unreasonable to expect your business partners to read this and have their lawyers comb through it every time you want to sign a contract.

Instead, Certificates of Liability Insurance are short, certified summaries that clients and others can look at and photocopy if they need a copy for their records.

What Happens if You Lose Your Certificate of Liability Insurance?

When your lose COI, just print a new one.

Don’t Take Their Word For It: Check the Certificate

Even if you trust someone when they tell you they have business insurance, you should always make sure to ask to see a copy of their insurance certificate.

Checking the COI can solve a number of problems, including:

- The other party may not have remembered their insurance details correctly

- Their insurance may have expired

- The other party may be misrepresenting their coverage

- Their limit may not be sufficient to cover the liabilities of the contract you’re signing

Don’t take any unnecessary risks. Your business partners should show you their coverage. Asking them for proof is also a good way to see how organized, professional, and experienced they are.

Get Your Certificate Quickly

WeInsureXYZ makes its insurance-buying process extremely efficient. Our customers are often small businesses that need insurance quickly in order to sign deals or meet their legal requirements.

Our online insurance application only takes minutes and you can get your insurance certificate emailed to you, usually within hours.

Many of our customers are extremely pleased with how quickly we’re able to cover them and send them a certificate. Our customer testimonials testify to our efficient service and quick certificate turnaround time.